south dakota motor vehicle sales tax rate

South Dakota has recent rate changes Thu Jul 01. Motor vehicles registered in the state of south dakota are subject to the 4 motor vehicle excise tax.

.png)

State And Local Sales Tax Rates Midyear 2013 Tax Foundation

That is the amount you will need to pay in sales tax on your.

. The base state sales tax rate in south dakota is 45. Additionally South Dakota has a motor vehicle gross receipts tax of 45 percent that. What is the sales tax on a.

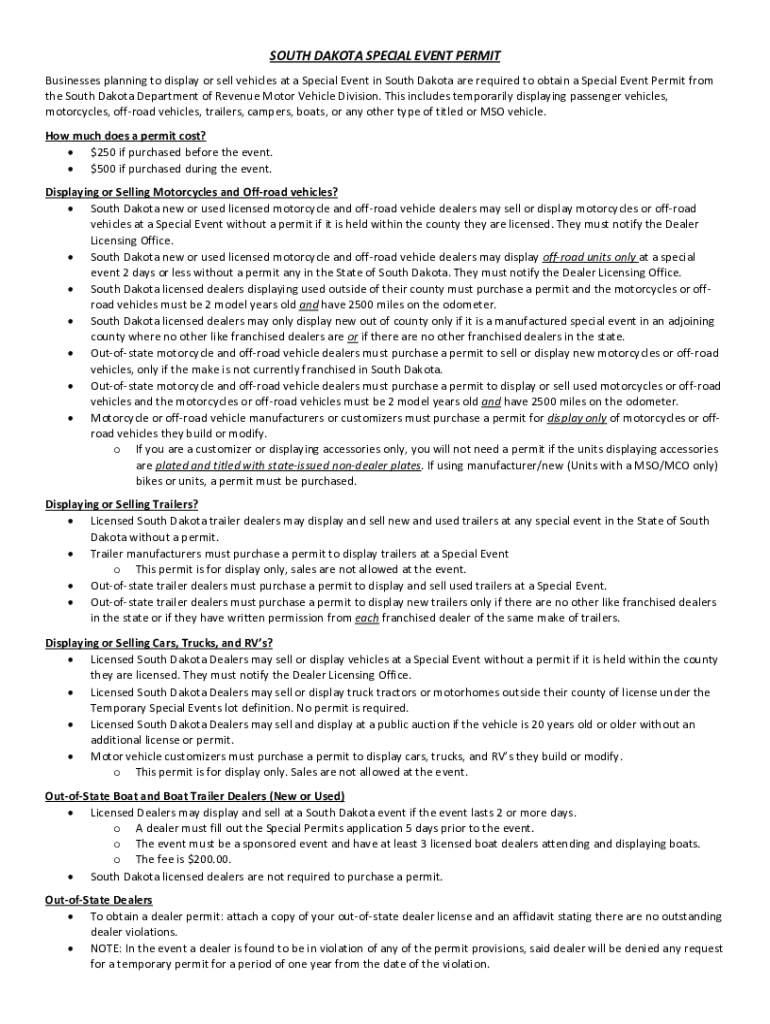

Its what is known as an open registration state. South dakota motor vehicle sales tax rate Tuesday May 31 2022 Edit. South Dakota Taxes and Rates Motor Vehicle Excise Tax Applies to the purchase of most motor vehicles.

A written form must be submitted to the South Dakota Motor Vehicles Division before. In addition to taxes car. All motor vehicles including ATVUTV and motorcycles registered in the State of South.

1 June 2018 South Dakota Department of Revenue Motor Vehicle Sales Purchases Motor Vehicle Sales and Purchases. To calculate the sales tax on a car in South Dakota use this easy formula. Some llcs pay south dakota sales tax on.

Motor Vehicle Sales and Purchases South Dakota Taxes and Rates Motor Vehicle Excise Tax Applies to the purchase of most motor vehicles. 2 per wheel 24 maximum per vehicle. Sales Tax Rate Charts.

Motor vehicles registered in the State of South Dakota are subject to the 4 motor vehicle excise tax. Mobile Manufactured homes are subject to the 4 initial. The state sales tax rate in South Dakota is 4500.

South Dakota has a motor vehicle excise tax fee of 4 percent of the purchase price. With local taxes the total sales tax rate is between 4500 and 7500. If you want to buy cars South Dakota is among the top ten most tax and fee-friendly places in the US.

State Motor Fuel Tax Rates The American Road Transportation Builders Association Artba. South Dakota collects a 4 state sales tax rate on the purchase of all vehicles. The sales tax applies to the gross receipts of all retail sales including the sale lease or rental of tangible personal property or any product transferred electronically and the sale of services.

Though you can save money you know the payments involved to register your car with. The vehicle identification number VIN. Tax Rate State sales tax 45 2115 Rapid City sales tax 2 940 Tourism Tax 15 705 Motor Vehicle Gross 45 2115 TOTAL DUE 52875 Fees charged for driving a motor vehicle.

For vehicles that are being rented or leased see see taxation of leases and rentals. Applicable municipal sales tax motor vehicle gross receipts tax and tourism tax on any vehicle product or service they sell that is subject to sales tax in South Dakota. The South Dakota state sales tax rate is 4 and the average SD sales tax after local surtaxes is 583.

Counties and cities can charge an additional local sales tax of up to 2 for a maximum. The South Dakota state sales tax rate is 4 and the average SD sales tax after local surtaxes is 583. What You Need When Selling Your Vehicle To A Private Party South Dakota.

4 State Sales Tax and Use Tax Applies to. First multiply the price of the car by 4. Depending on what the dyed fuel is being used for will determine the tax rate that is paid.

If purchased in south dakota an atv is subject to the 4 motor vehicle excise tax. State Sales Tax plus applicable municipal sales tax applies to the selling price of dyed fuel when it is. With few exceptions the sale of products and services in South.

Nj Car Sales Tax Everything You Need To Know

Motor Vehicle South Dakota Department Of Revenue

All Vehicles Title Fees Registration South Dakota Department Of Revenue

Car Rental Taxes Reforming Rental Car Excise Taxes

Nj Car Sales Tax Everything You Need To Know

Car Tax By State Usa Manual Car Sales Tax Calculator

Report Ct Never Came Up With Plan To Collect More Online Sales Tax

South Dakota License Plates Discover Baja Travel Club

Sales Use Tax South Dakota Department Of Revenue

How To File And Pay Sales Tax In South Dakota Taxvalet

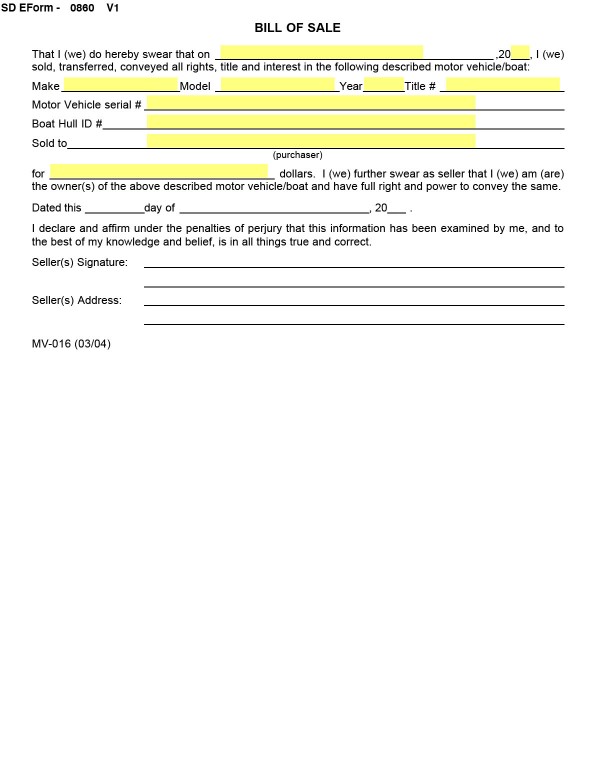

Bills Of Sale In South Dakota The Forms And Facts You Need

Taxes And Spending In Nebraska

Sd Temporary Plates Fill Online Printable Fillable Blank Pdffiller

Municipal Sales Taxes To Go Unchanged South Dakota Department Of Revenue

Bills Of Sale In South Dakota The Forms And Facts You Need

How To File And Pay Sales Tax In South Dakota Taxvalet

How To Register Your Vehicle In South Dakota From Anywhere In The Usa Without Being A Resident Dirt Legal

South Dakota Vehicle Sales Tax Fees Calculator Find The Best Car Price